DAY TRADING OR SWING TRADING?

What's the difference between Day Trading, Swing Trading & Investing?

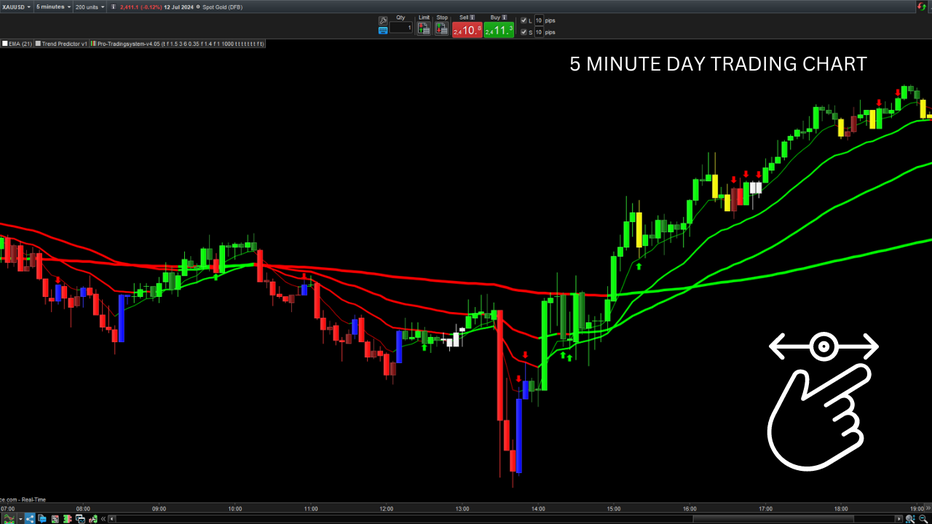

Would you prefer your charts to look like this or this below? (Scroll left to right on the chart to see)

Day trading, swing trading, and investing are three distinct approaches to engaging with financial markets, each with unique strategies, time horizons, risk profiles, and goals. Understanding the differences among these methods can help individuals choose the most suitable approach for their financial objectives and risk tolerance.

Day Trading

Day trading involves buying and selling financial instruments within a single trading day. Traders aim to profit from short-term price movements in stocks, currencies, commodities, or other securities. They typically close all positions by the end of the trading day to avoid overnight risk. Key characteristics of day trading include:

- Time Horizon: Very short, ranging from seconds to hours.

- Frequency of Trades: High, often executing multiple trades in a single day.

- Analysis: Primarily technical analysis, using charts, patterns, and indicators to make quick decisions.

- Risk Management: Strict risk management techniques to minimise losses, including stop-loss orders and position sizing.

- Tools: Advanced trading platforms, real-time data feeds, and sophisticated charting tools.

- Skills Required: Quick decision-making, focus, discipline, and the ability to handle stress.

Day trading can be highly profitable.

Swing Trading

Swing trading spans a longer timeframe than day trading, holding positions for several days to weeks. Swing traders aim to capture medium-term price movements or "swings" within a broader trend. Key characteristics of swing trading include:

- Time Horizon: Medium-term, ranging from days to weeks.

- Frequency of Trades: Lower than day trading, with fewer trades held for longer periods.

- Analysis: Combination of technical and fundamental analysis, focusing on chart patterns, trends, and market sentiment.

- Risk Management: Use of stop-loss orders and position sizing, but with a longer-term perspective compared to day trading.

- Tools: Charting software, trend analysis tools, and fundamental data sources.

- Skills Required: Analytical skills, patience, and the ability to manage trades over several days.

Swing trading offers a balance between the fast pace of day trading and the long-term commitment of investing. It allows traders to take advantage of market volatility without the need for constant monitoring.

Investing

Investing involves buying and holding assets over a long period, often years or decades, with the goal of wealth accumulation and income generation. Investors focus on the underlying value and potential growth of assets, such as stocks, bonds, real estate, or mutual funds. Key characteristics of investing include:

- Time Horizon: Long-term, typically years to decades

- Frequency of Trades: Low, with infrequent buying and selling based on long-term goals

- Analysis: Primarily fundamental analysis, evaluating company financials, economic conditions, and market trends

- Risk Management: Diversification across asset classes and sectors to spread risk

- Tools: Financial statements, economic reports, and portfolio management software

- Skills Required: Long-term vision, patience, and the ability to evaluate financial fundamentals.

- Frequency of Trades: Low, with infrequent buying and selling based on long-term goals

- Analysis: Primarily fundamental analysis, evaluating company financials, economic conditions, and market trends

- Risk Management: Diversification across asset classes and sectors to spread risk

- Tools: Financial statements, economic reports, and portfolio management software

- Skills Required: Long-term vision, patience, and the ability to evaluate financial fundamentals.

Investing aims to build wealth through capital appreciation, dividends, and interest. It requires less day-to-day involvement compared to trading and is generally considered less risky, although market downturns can still impact portfolio value.

Comparison and Conclusion

- Time Commitment: Day trading demands the most time and attention, swing trading requires moderate time, and investing involves the least day-to-day commitment.

- Risk and Reward: Day trading carries the highest risk and potential reward, swing trading balances risk and reward, and investing offers lower risk with steady, long-term growth.

- Skill Set: Day traders need quick reflexes and stress management, swing traders need strong analytical skills, and investors need patience and a deep understanding of financial fundamentals.

Choosing between day trading, swing trading, and investing depends on one's financial goals, risk tolerance, time availability, and personal skills. Each approach has its merits and can be effective when applied correctly within the context of an individual's overall financial plan.